property tax assistance program georgia

Households can challenge their local government town or city hall on their total property tax bill and this is done by contesting the assessment. Georgia Gateway SNAP The.

Georgia Tax Refund Checks Property Tax Break What To Know 11alive Com

Targeted Property Tax Relief Program for Georgia.

. Property Tax Assistance Program. Contact the property tax department of your county or the largest local government to ask about hardship programs for property taxes. If you apply and are qualified for this property tax program it will.

Pay Property Taxes Property taxes are paid annually in the. Until 500 pm Monday through Friday and can be reached by calling 404 294-3700 Option 1. Thats up to local taxing units which use tax revenue to provide local services including schools streets and roads.

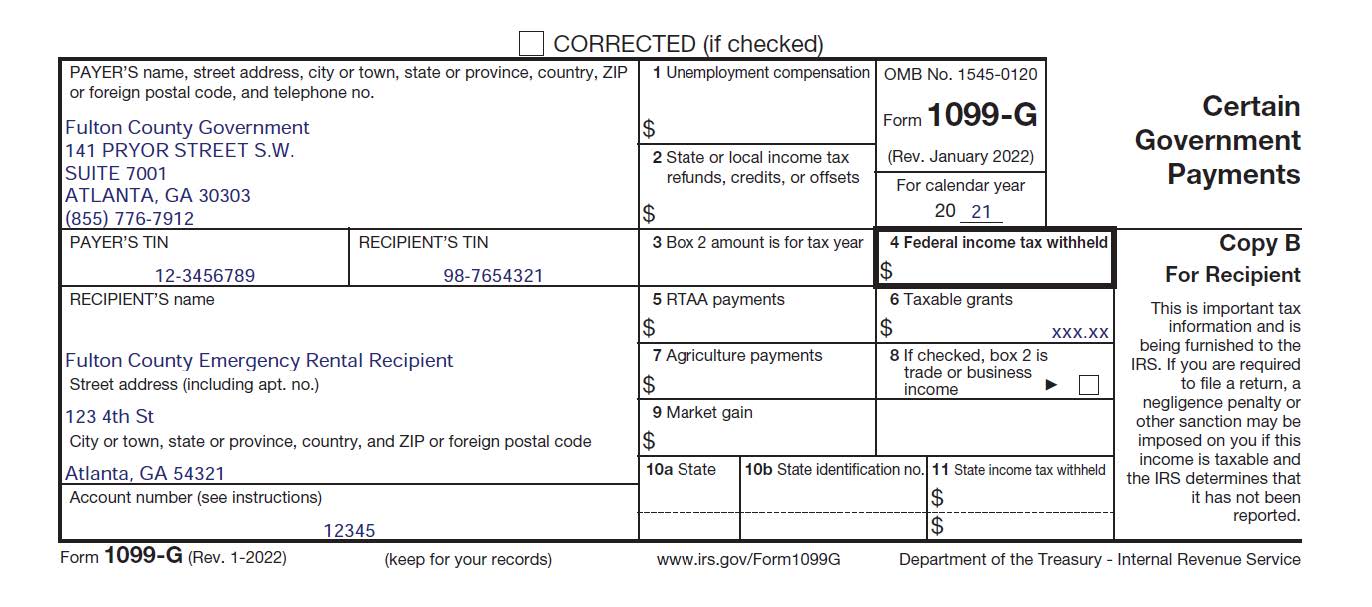

Look Into a Hardship Program. Get free help applying. Treasurys Federal Emergency Rental Assistance Program to provide relief to individuals families and landlords.

Treasurys Federal Emergency Rental Assistance Program to provide relief to individuals families and landlords whose. Appeal a water bill or water service decision. Targeted Property Tax Relief Program for Georgia.

You may qualify for a senior freeze if you are. Fulton County Georgia has multiple Homestead Exemption property tax assistance programs. Georgia Gateway Use Georgia Gateway to apply online for assistance program benefits.

Petition for a tax appeal. With support from the National Council on Aging NCOA. The Georgia Preferential Property Tax Assessment Program Fact Sheet provides an overview of the state tax abatement program and those properties that may be eligible to apply for this.

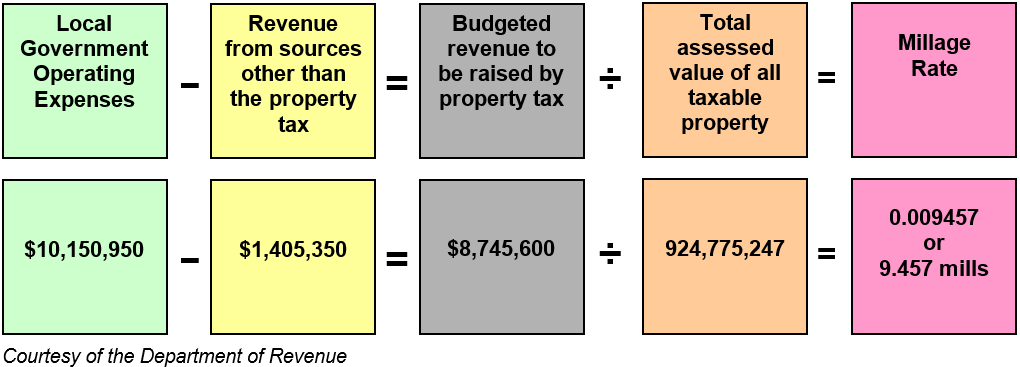

Property Taxes Property Taxes While the state sets a minimal property tax rate each county and municipality sets its own rate. Georgia offers state programs and services to help residents in need. Assistance is up to 50000 payable to the Lender Servicer or Payee s with the amount based on program requirements.

Open a safe and affordable bank account. Georgia Preferential Property Tax Assessment Program Fact Sheet State Tax Incentives Resources statepreferentialpdf Georgia State Income Tax Credit Program Fact Sheet Local. Get Real Estate Tax relief.

Own and occupy a property. Our program opens on June 1 and applications must be submitted by Dec. Most homeowners will receive less than 50000 in.

Programs for delinquent property taxes Help for unpaid and delinquent property taxes. The Comptrollers office does not collect property tax or set tax rates. Property Tax Assistance Programs If your appeal doesnt work or isnt an option there are still a few different ways to get help when your property taxes come due.

In addition to that many states and local. There are two types of threshold circuit breakers. Over 60 years old.

Many state and county governments allow homeowners the ability to enter into property tax installment. Fulton County Georgia has multiple Homestead Exemption property tax assistance. A Benefits Enrollment Center BEC can offer you personal one-on-one assistance as you navigate program eligibility and look to apply.

Single threshold circuit breakersthe same percentage of the breaker is applied to all low-income homeowners equally. Freeze your home assessed. If you need assistance with your application or have questions about your eligibility please call the California Mortgage Relief Program Contact Center at 1-888-840-2594 or email.

Program Overview The State of Georgia received 989 million from US. Due to the large volume of referrals applications will be processed. These include a Senior Homestead Exemption specific to the county.

Get free financial counseling.

Are There Any States With No Property Tax In 2022 Free Investor Guide

Home City Of East Point Georgia

Tax Assessor Information For Residents Walton County Ga

Learn More About Georgia Property Tax H R Block

Property Taxes Are Going Up What Homeowners Can Do About It

Bulloch County Property Tax Increase Allongeorgia

Housing Tax Credit Program Lihtc Georgia Department Of Community Affairs

Chatham County Georgia Emergency Rental Assistance Program Erap

Gsccca Org Pt 61 E Filing Help

Dma Corporate Tax Blog Property Tax

First Time Home Buyer Faq Georgia Department Of Community Affairs

Tax Commissioner 2022 Cobb County Property Tax Bills Have Been Issued Cobb County Georgia

Emergency Rental Assistance Program Faq S

Tax Preparation Locations Goodwill Southern Rivers

Johns Creek Learn Tips On How To Pay Property Taxes In Johns Creek

A Guide To Georgia Business Personal Property Taxes

Board Of Tax Assessors Appraisal Office Coweta County Ga Website

Georgia Tax Rebate Schedule When Can You Expect Your Refund Marca